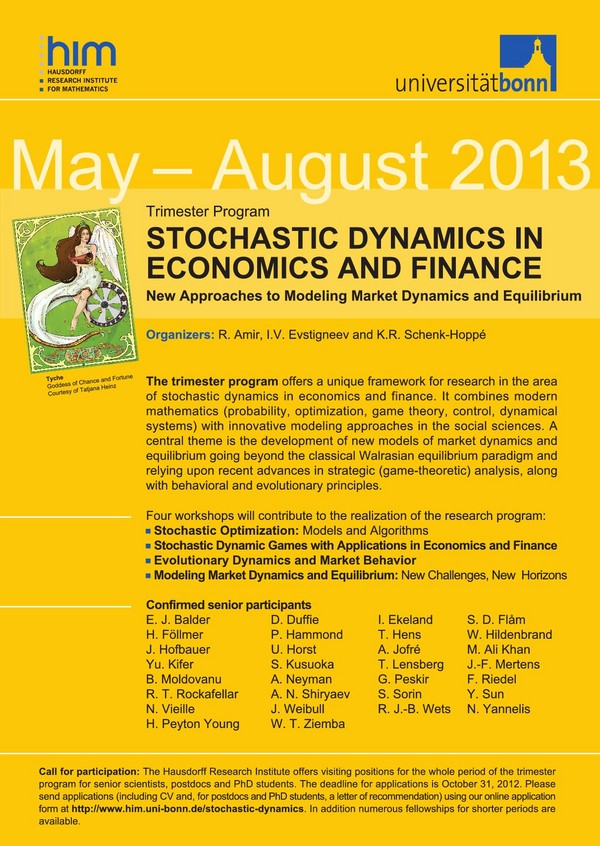

May 2 - August 23, 2013

Organizers: R. Amir, I. V. Evstigneev, K. R. Schenk-Hoppé

Description: The trimester program offered a unique framework for research in the area of stochastic dynamics in economics and finance. It combined modern mathematics (probability, optimization, game theory, control, dynamical systems) with innovative modeling approaches in the social sciences. A central theme was the development of new models of market dynamics and equilibrium going beyond the classical Walrasian equilibrium paradigm and relying upon recent advances in strategic (game-theoretic) analysis, along with behavioral and evolutionary principles.

Associated Events: Four workshops contributed to the realization of the research program:

- 27-29 May 2013

Stochastic Optimization: Models and Algorithms

Organizers: Jofré, Rockafellar and Ziemba - 17-20 June 2013

Stochastic Dynamic Games with Applications in Economics and Finance

Organizers: Amir, Kifer, Riedel and Vieille - 15-18 July 2013

Evolutionary Dynamics and Market Behavior

Organizers: Hofbauer and Sorin - 19-22 August 2013

Modeling Market Dynamics and Equilibrium: New Challenges, New Horizons

Organizers: Evstigneev and Schenk-Hoppé

| No. | Author(s) | Title | Preprint | Publication |

| 2013b01 | Lensberg, T.; Schenk-Hoppé, K. R. | Hedging without sweat: a genetic programming approach | 1305.6762 | Quantitative Finance Letters, 1(1) (2013), 41–46. https://doi.org/10.1080/21649502.2013.813166 |

| 2013b02 | Ladley, D.; Lensberg, T.; Palczewski, J.; Schenk-Hoppé, K. R. | Fragmentation and stability of markets | ssrn.2304450 | J of Econ. Behavior & Organization. 119 (2015), 466-481. https://doi.org/10.1016/j.jebo.2015.09.013 |

| 2013b03 | De Angelis, T.; Ferrari, G. | A stochastic partially reversible investment problem on a finite time-horizon: free-boundary analysis | 1303.6189 | Stochastic Process. Appl. 124(12) (2014), 4080–4119. https://doi.org/10.1016/j.spa.2014.07.008 |

| 2013b04 | Ferrari, G. | On an integral equation for the free-boundary of stochastic, irreversible investment problems | 1211.0412 | Ann. Appl. Probab. 25(1) (2015), 150–176. https://doi.org/10.1214/13-AAP991 |

| 2013b05 | Khan, M. A.; Rath, K. P.; Sun, Y.; Yu, H. | Strategic uncertainty and the ex post Nash property in large games | Theor. Econ. 10(1) (2015), 103–129. https://doi.org/10.3982/TE1492 |

|

| 2013b06 | Khan, M. A.; Schlee, E. | On Lionel McKenzie's 1957 intrusion into 20th-century demand theory | ssrn.2326551 | Canadian Journal of Economics. 49(2) (2016), 589 – 636. https://doi.org/10.1111/caje.12207 |

| 2013b07 | Khan, M. A.; Sagara, N. | The bang-bang, purification and convexity principles in infinite dimensions: additional characterizations of the saturation property | Set-Valued Var. Anal. 22(4) (2014), 721–746. https://doi.org/10.1007/s11228-014-0282-7 |

|

| 2013b08 | Bogachev, L. V.; Zeindler, D. | Asymptotic statistics of cycles in surrogate-spatial permutations | 1309.7986 | Comm. Math. Phys. 334(1) (2015), 39–116. https://doi.org/10.1007/s00220-014-2110-1 |

| 2013b09 | Davis, M. H.A.; Lleo, S. | Risk-sensitive investment management | Adv. S. on Statistical Sci. & Appl. Proba. 19 (2014). https://doi.org/10.1142/9026 |

|

| 2013b10 | Davis, M. H.A.; Lleo, S. | Jump-diffusion asset–liability management via risk-sensitive control | OR Spectrum. 37(3) (2015), 655–675. https://doi.org/10.1007/s00291-014-0371-x |

|

| 2013b11 | Lleo, S.; Ziemba, W. T. | Does the bond-stock earning yield differential model predict equity market corrections better than high P/E models? | ssrn.2296836 | Financial Markets, Institutions & Instruments. 26(2) (2017), 61 – 123. https://doi.org/10.1111/fmii.12080 |

| 2013b12 | Kim, W. C.; Fabozzi, F. J.; Cheridito, P.; Fox, C. | Controlling portfolio skewness and kurtosis without directly optimizing third and fourth moments | Econom. Lett. 122(2) (2014), 154–158. https://doi.org/10.1016/j.econlet.2013.11.024 |

|

| 2013b13 | Backhoff Veraguas, J. D.; Fontbona; J. | Robust utility maximization without model compactness | 1405.0251 | SIAM J. Financial Math. 7(1) (2016), 70–103. https://doi.org/10.1137/140985718 |

| 2013b14 | Backhoff Veraguas, J. D.; Silva Álvarez, F. J. | Sensitivity results in stochastic optimal control: a Lagrangian perspective | 1404.0586 | ESAIM Control Optim. Calc. Var. 23(1) (2017), 39–70. https://doi.org/10.1051/cocv/2015039 |

| 2013b15 | Kim, W. C.; Lee, J. H. | Characteristics of robust portfolios in a varied asset universe | Quantitative Finance Letters. 1(1) (2013), 21–29. http://dx.doi.org/10.1080/21649502.2013.812718 |

|

| 2013b16 | Föllmer, H. | Spatial risk measures and their local specification: the locally law-invariant case | Stat. Risk Model. 31(1) (2014), 79–101. https://doi.org/10.1515/strm-2013-5001 |

|

| 2013b17 | He, W.; Sun, X. | On the diffuseness of incomplete information game | 1307.5271 | J. Math. Econom. 54 (2014), 131–137. https://doi.org/10.1016/j.jmateco.2014.01.004 |

| 2013b18 | Bensoussan, A.; Frehse, J.; Yam, P. | Mean field games and mean field type control theory | Springer. (2013). https://doi.org/10.1007/978-1-4614-8508-7 |

|

| 2013b19 | Bensoussan, A.; Frehse, J.; Yam, P. | The master equation in mean field theory | 1404.4150 | J. Math. Pures Appl. 103(6) (2015), 1441–1474. https://doi.org/10.1016/j.matpur.2014.11.005 |

| 2013b20 | Bensoussan, A.; Siu, C. C.; Yam, S. C. P.; Yang, H. | A class of non-zero-sum stochastic differential investment and reinsurance games | Automatica J. 50(8) (2014), 2025–2037. https://doi.org/10.1016/j.automatica.2014.05.033 |

|

| 2013b21 | Bensoussan, A.; Chau, M.; Yam, P. | Mean field games with a dominating player | 1404.4148 | Appl. Math. Optim. 74(1) (2016), 91–128. https://doi.org/10.1007/s00245-015-9309-1 |

| 2013b22 | Shiryaev, A.N.; Zhitlukhin, M.V.; Ziemba, W.T. | Land and stock bubbles, crashes and exit strategies In Japan circa 1990 and in 2013 | ssrn.2346236 | Quant. Finance. 15(9) (2015), 1449–1469. https://doi.org/10.1080/14697688.2014.989897 |

| 2013b23 | De Angelis, T.; Ferrari, G.; Moriarty, J. | A non-convex singular stochastic control problem and its related optimal stopping boundaries | 1405.2442 | SIAM J. Control Optim. 53(3) (2015), 1199–1223. https://doi.org/10.1137/14096801X |

| 2013b24 | Hörner, J.; Klein, N.; Rady, S. | Strongly symmetric equilibria in bandit games | Cowles Foundation. 2364 (2014). https://elischolar.library.yale.edu/cowles-discussion-paper-series/2364 |

|

| 2013b25 | Elmiger, S. | Can CRRA preferences explain CAPM-anomalies in the cross-section of stock returns? | ssrn.2312273 | Swiss Finance Institute Research Paper. (2013), 13-43. https://doi.org/10.5167/uzh-93699 |

| 2013b26 | Palczewski, J.; Stettner, Ł. | Infinite horizon stopping problems with (nearly) total reward criteria | 1401.6905 | Stochastic Process. Appl. 124(12) (2014), 3887–3920. https://doi.org/10.1016/j.spa.2014.07.009 |

| 2013b27 | Moriarty, J.; Palczewski, J. | American call options for power system balancing | ssrn.2508258 | |

| 2013b28 | V'yugin, V. | Log-optimal portfolio selection using the Blackwell approachability theorem | 1410.5996 | |

| 2013b29 | Lensberg, T.; Schenk-Hoppé, K. R.; Ladley, D. | Costs and benefits of financial regulation: Short-selling bans and transaction taxes | Journal of Banking & Finance. 51 (2015), 103-118. https://doi.org/10.1016/j.jbankfin.2014.10.014 |

|

| 2013b30 | Palczewski, J.; Poulsen, R.; Schenk-Hoppé, K. R.; Wang, H. | Dynamic portfolio optimization with transaction costs and state-dependent drift | European J. Oper. Res. 243(3) (2015), 921–931. https://doi.org/10.1016/j.ejor.2014.12.040 |

|

| 2013b31 | Amir, R.; Evstigneev, I. V. | On Zermelo's theorem | 1610.07160 | J. Dyn. Games. 4(3) (2017), 191–194. https://doi.org/10.3934/jdg.2017011 |

| 2013b32 | Mertikopoulos, P.; Sandholm, W. H. | Riemannian game dynamics | 1603.09173 | J. Econom. Theory. 177 (2018), 315–364. https://doi.org/10.1016/j.jet.2018.06.002 |

| 2013b33 | Steg, J-H. | Symmetric equilibria in stochastic timing games | 1507.04797 | |

| 2013b34 | Ziliotto, B. | Zero-sum repeated games: counterexamples to the existence of the asymptotic value and the conjecture maxmin = lim vn | 1305.4778 | Ann. Probab. 44(2) (2016), 1107–1133. https://doi.org/10.1214/14-AOP997 |

| 2013b35 | Graewe, P.; Horst, U.; Qiu, J. | A non-Markovian liquidation problem and backward SPDEs with singular terminal conditions | 1309.0461 | SIAM J. Control Optim. 53(2) (2015), 690–711. https://doi.org/10.1137/130944084 |

| 2013b36 | Graewe, P.; Horst, U.; Séré, E. | Smooth solutions to portfolio liquidation problems under price-sensitive market impact | 1309.0474 | Stochastic Process. Appl. 128(3) (2018), 979–1006. https://doi.org/10.1016/j.spa.2017.06.013 |

| 2013b37 | Mertikopoulos, P.; Kwon, J. | A continuous-time approach to online optimization | 1401.6956 | J. Dyn. Games. 4(2) (2017), 125–148. https://doi.org/10.3934/jdg.2017008 |

| 2013b38 | Mertikopoulos, P.; Sandholm, W. H. | Learning in games via reinforcement and regularization | 1407.6267 | Math. Oper. Res. 41(4) (2016), 1297–1324. https://doi.org/10.1287/moor.2016.0778 |

| 2013b39 | Davis, M. H.A. | Verification of internal risk measure estimates | 1410.4382 | Stat. Risk Model. 33(3-4) (2016), 67–93. https://doi.org/10.1515/strm-2015-0007 |

| 2013b40 | Bravo, M.; Mertikopoulos, P. | On the robustness of learning in games with stochastically perturbed payoff observations | 1412.6565 | Games Econom. Behav. 103 (2017), 41–66. https://doi.org/10.1016/j.geb.2016.06.004 |

| 2013b41 | Belkina, T.; Luo, S. | Asymptotic investment behaviors under a jump-diffusion risk process | 1502.02286 | N. Am. Actuar. J. 21(1) (2017), 36–62. https://doi.org/10.1080/10920277.2016.1246252 |

| Name | Affiliation |

| Husnain Fateh Ahmad | University of Iowa |

| Gohar Aleksanyan | Instituto Superior Tecnico IST |

| Beth Allen | University of Minnesota |

| Rabah Amir | University of Iowa |

| Stefan Ankirchner | Universität Bonn |

| Nikhil Atreya | NHH |

| Natalie Attard | University of Malta |

| Julio Daniel Backhoff | Humboldt Universität zu Berlin |

| Erik Jan Balder | University of Utrecht |

| Tatiana Belkina | Central Economics and Mathematics Institute RAS |

| Nina Bobkova | Universität Bonn |

| Leonid Bogachev | University of Leeds |

| Luciano de Castro | Northwestern University |

| Yifan Dai | University of Iowa |

| Mark Davis | Imperial College London |

| Tiziano De Angelis | The University of Manchester |

| Amogh Deshpande | University of Warwick |

| Omer Edhan | University of Manchester |

| Sabine Elmiger | University of Zürich |

| Igor Evstigneev | University of Manchester |

| Giorgio Ferrari | Universität Bielefeld |

| Sjur Didrik Flåm | University of Bergen |

| Joaquin Fontbona | Universidad de Chile |

| James C. L. Fung | University of Leeds |

| Hans Föllmer | Humboldt Universität zu Berlin |

| Adriana Gama-Velazquez | University of Iowa |

| Pavel Gapeev | London School of Economics |

| Olga Gorelkina | Toulouse School of Economics |

| Ani Guerdjikova | University of Cergy-Pontoise |

| V. Matthias Gundlach | Technische Hochschule Mittelhessen |

| Alexander Gushchin | Moscow State University |

| Peter J. Hammond | University of Warwick |

| Wei He | National University of Singapore |

| Thorsten Hens | University of Zurich |

| Josef Hofbauer | Universität Wien |

| Ulrich Horst | Humboldt-Universität Berlin |

| Sang Hu | The Chinese University of Hong Kong |

| Johannes Hörner | Yale University |

| Alejandro Jofré | University of Chile |

| Grigory Kabatyanskiy | Institute for Information Transmission Problems RAS |

| Mohammed Ali Khan | John Hopkins University |

| Yurii Khomskii | University of Vienna |

| Yuri Kifer | The Hebrew University |

| Woo Chang Kim | Korea Advanced Institute of Science and Technology |

| Yerkin Kitapbayev | The University of Manchester |

| Malgorzata Knauff | Warsaw School of Economics |

| Alexander Kolesnikov | Higher School of Economics |

| Leonidas Koutsougeras | University of Manchester |

| Joon Kwon | Université Pierre et Marie Curie - Paris 6 |

| Hans Terje Lensberg | Norwegian School of Economics |

| Xiaoxi Li | Pierre et Marie Curie (Paris 6) |

| Gechun Liang | King's College London |

| Sebastien Lleo | Reims Management School |

| Juan Pablo Maldonado Lopez | Université Pierre et Marie Curie - Paris 6 |

| John Moriarty | University of Manchester |

| Alexey Muravlev | Steklov Mathematical Institute |

| Miquel Oliu Barton | Université Pierre et Marie Curie - Paris 6 |

| Ekaterina Palamarchuk | Central Economics and Mathematics Institute of RAS |

| Jan Palczewski | University of Leeds |

| Marilyn Pease | University of Iowa |

| Goran Peskir | University of Manchester |

| Shi Qiu | The University of Manchester |

| Sven Rady | Universität Bonn |

| Frank Riedel | Bielefeld University |

| R.Tyrrell Rockafellar | University of Washington |

| Neofytos Rodosthenous | London School of Economics and Political Science |

| Klaus Reiner Schenk-Hoppé | University of Leeds |

| Albert Shiryaev | Steklov Mathematical Institute Academy of Sciences of Russia |

| Francisco José Silva | Université de Limoges |

| Anastasiia Sokko | University of Zurich |

| Sylvain Sorin | Université Pierre et Marie Curie - Paris 6 |

| Yeneng Sun | National University of Singapore |

| Xiang Sun | National University of Singapore |

| Tymon Tatur | Universität Bonn |

| Alexander Veretennikov | University of Leeds |

| Nicolas Vieille | HEC Paris |

| Vladimir Viyugin | Institute for Information Transmission Problems |

| Tongya Wang | The University of Leeds |

| Katarzyna Werner | University of Manchester |

| Jan Werner | University of Minnesota |

| Roger Wets | University of California at Davis |

| Le Xu | National University of Singapore |

| Zibo Xu | Stockholm School of Economics |

| Phillip Sheung Chi Yam | The Chinese University of Hong Kong |

| Yongchao Zhang | Shanghai University of Finance and Economics |

| Mikhail Zhitlukhin | The University of Manchester |

| Shengchao Zhuang | The Chinese University of Hong Kong |

| William T. Ziemba | University of British Columbia |

| Bruno Ziliotto | Université Toulouse 1 |

This list does not include people who only participated in the workshops.